- Best budget apps that link to bank account manual#

- Best budget apps that link to bank account trial#

- Best budget apps that link to bank account free#

Best budget apps that link to bank account free#

Frollo offers free and secure synchronisation with your bank accounts, credit cards, loans, superannuation and investments into an interface that allows you to monitor your spending.

Push notifications and personal insights.Set savings goals, budgets and track progress.Automatically finding the cheapest gas and electricity deals based on your usage data.Automatic categorisation for transactions.Sync to Australian bank accounts – including superannuation and investments.But this hasn’t stopped it being downloaded more than 50,000 times from Google Play and earning a 4.5-star rating on the Apple App Store from more than 3,000 reviews.

Best budget apps that link to bank account trial#

Offering significant depth of features, MoneyBrilliant is not free – it costs $9.90 per month after a 30-day trial period. MoneyBrilliant also has a tax deductions function, finding potentially tax-deductible expenses based on your occupation. It also features the ability to sync ALL of your money in-app including superannuation and investment portfolios. MoneyBrilliant connects to more than 200 financial institutions across Australia and syncs your spending to categories. Bank-level security to protect your information and money.A chatbot is available for you to ask questions like “how much did I save last month?”.Savings tips sent via push notification, based on machine learning that can also predict your future spending.Personalised insights into your spending, including categorisation.Cashback options are available after spending money with linked brands.Your money can be invested in one of six diversified ETF (exchange-traded fund) portfolios.Lump-sum and recurring investment options, easily allowing you to invest more money at the touch of a button.Roundup technology, allowing you to either save or invest every time you spend through your linked transaction account/s.Importantly, it costs nothing to use the savings feature on offer by Raiz. Sapphire portfolio: $3.50 per month or 0.275% per year.Custom portfolio: $4.50 per month for accounts under $20,000 and 0.275% per year for accounts more than $20,000.Standard portfolio: $3.50 per month for accounts under $15,000 and 0.275% per year for accounts more than $15,000.The investment platform of Raiz might come with fees: This feature can categorise your spending into things like food or utilities and breaks it down on a month-to-month basis. Not only can you utilise the micro-investing or recurring deposit features as a tool to save via investments, but it also has a free ‘My Finance’ feature within the app that provides personalised insights into your spending. Raizįormerly known as ‘Acorns Australia’, Raiz is a micro-investing app that allows users to invest in a portfolio of ETFs (exchange-traded funds) through spare change ’roundups’, recurring investments, rewards and lump sum deposits.Īlthough it’s primarily an investment app, it also has features that are helpful for saving.

Best budget apps that link to bank account manual#

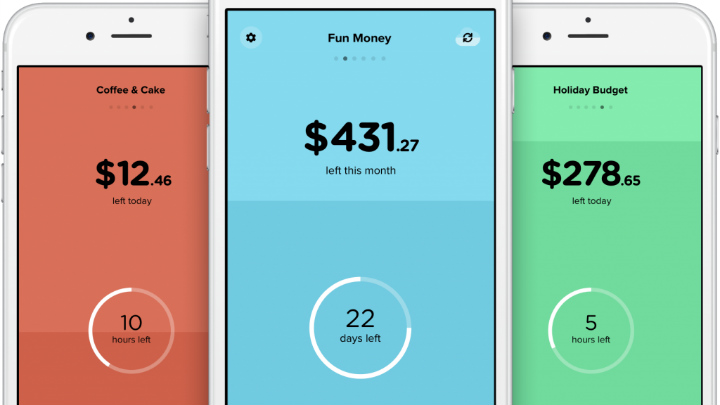

Whether automatic of manual syncing is required, the goal is simply to provide a categorical breakdown of your monthly spending so you can decide how and where to make cutbacks. Spending tracker appsĮach of these apps offer various levels of functionality - either syncing with your bank accounts or requiring a slightly more manual approach. Sure you may still like to get your budgeting advice from TikTok, but ultimately to make use of these apps, your phone and to push your money further, in no particular order here are some of the most popular budgeting and savings apps available to Australians. Today, personal finance apps have become the new norm for Aussies looking to budget and save with thousands available through either Apple's App Store on iOS or Google's Play Store. With the rise of personal computers, digital spreadsheets then became the go-to, until now.

It sounds simple enough, but in reality identifying where you can spend less money and finding practical ways to improve them can be challenging.īack in the day, people would pore through receipts on a Sunday night and write all their expenditures down. With a number of Aussies copping the brunt of inflation, cost of living pressures and rising interest rates, there are a number of ways you can save including refinancing to a lower rate on your home loan, opting for a used car over a new one, cutting down on credit card interest and more.

0 kommentar(er)

0 kommentar(er)